Trade Lines

We offer you a fully automated ordering system offering a wide variety of seasoned trade lines, 24/7 online access, support, competitive pricing and the option to pre-order trade lines. It’s easy, convenient, fast and secure.

How It Works

We add you as an authorized user to one of the tradelines that has the available limit and positive payment history.

The Issuing Bank

i.e. (Bank of America, Chase, Discover, Wells Fargo, CITI) then reports the positive history including the age of the account, the limit to the tradeline and the positive payment history to Experian, TransUnion and Equifax.

The Payment History

age, and limit have direct impact on the FICO score module which impacts your utilization ratio, average credit age and payment history.

Free Consultation

We take the stress away from buying authorized user trade lines contact us today for your free consultation!

Authorized User Tradelines for Sale at Broker Prices

Finding a trusted resource for authorized user tradelines for sale can prove to be a challenging venture; we set out to be a tradeline company that offers clients reliability and trust. Our 60 day money back assurance makes sure you get what you pay for.

Why consider Tradelines for Sale from an 5+ Rated company?

A tradeline gathers information by creating an entry to your history for the grantor. The information gathered includes the list of the companies related to your accounts, the dates in which your accounts were opened, the types of accounts that you have, the payment history of your accounts, the owed balances in your accounts, your limits and more. In this article, we will dig much deeper for you to better understand the reasons why it is wise to buy authorized user tradelines.

What are authorized user tradelines?

To make everything clear for everyone, let us start with the basics.

Authorized user tradelines refer to the card account where you are added as the authorized user. A “tradeline” is the account listed in a report, such as credit cards, auto loans, mortgages, and others. An “authorized user”, on the other hand, is the person who has been given access to an account as a user. This person acting as a user, however, is not necessarily accountable for the balances in the said account.

Buy Tradelines

Why buy aged authorized user tradelines?

There can be a number of different reasons to purchase authorized user tradelines. Below is the list of the biggest, most important factors why you might want to buy authorized user tradelines.

-

Authorized user trade lines give you report.

With an authorized user trPersonalTradelines.comadeline, you can keep track of your credit account status on a regular basis. There are authorized user trade lines for sale at PersonalTradelines.com. Use personal tradelines and your tradelines will post. Our fully automated ordering system offers a wide range of tradelines with online access, customer support, and several options of pre-order tradelines. Working with this company is fast, easy, convenient, and secure for you. With its money-back assurance, you can feel comfortable working with this tradeline company to achieve your biggest financial goals. Purchase personal tradelines today!

-

Aged authorized user trade lines work through time.

Authorized user tradelines work along with the course of time. There have been a number of changes in the industry and authorized user tradelines have managed to shift along with these changes as they come.

-

Authorized user trade lines are available 24/7.

Tradelines for Sale

Authorized user tradelines are not difficult to find. They are available at any time. There are a number of places to purchase tradelines for sale.

Research

According to the NFCC (National Foundation for Credit Counseling), only 56% of consumers in the US had checked their credit score and report in 2016.

All you need to know about tradeline

Here are tips:

- Keep a tab on your credit history and report, and also get a copy for each financial year

- Identify and take care of every negative account on your report

- Retain positive accounts and let them mature over time

- Get in touch with the collection agencies and ensure that paying off a negative account will imply taking it off your credit report

- What are trade lines?

The term “tradelines” is a technical one that finance professionals use. Tradelines are nothing but accounts which are open in someone’s financial report and also appear in their credit report.

Example of a tradeline: A car loan, a credit card, a mortgage on your home, and so on. These accounts are updated and maintained on your credit report.

- What are seasoned tradelines?

When an account has been maintained and paid for over a period of many years, it becomes known as a seasoned tradeline.

- What are authorized tradeline?

The original holder of an account places lines of credit giving another user authority on the account. Hence, it becomes an “authorized” tradeline. In such a case, there’s only an additional authority given, but the new user has no obligation of repayment towards the tradeline.

- Once approved and posted, the tradeline appears from the next credit report cycle

- For any debt incurred on that tradeline, only the original/primary account holder is responsible

- The authorized user can also remove themselves from this account just as easily

Credit Repair vs. Tradelines – We DO NOT Offer Credit Repair.

What credit repair does:

- Removing inaccurate information

What tradelines add-on to the equation:

- Utilization ratios

- Age and updated personal information

- Previous and current credit limits

- Perfect payment history

Buying a Tradeline from Personal Tradelines

Why you should choose us to purchase a tradeline:

- Purchase Seasoned tradelines, verified and vetted by us

- 5 + Ratings

- Online access 24/7, always at your convenience

- Complete support from our experts

- Prices that are affordable, and competitive

- Service that is quick, reliable, easy to avail, and hassle-free

- An option to pre-order your tradelines purchase

More Information on Tradelines for Sale

If you’re thinking of purchasing tradelines, you need to make sure that you proceed with caution so that you don’t make any mistakes. Tradelines are wonderful tools that may enhance your credit, though when not applied correctly, they can do more harm than good.

Let’s take a look at the top tradeline-buying mistakes.

Having Credit Card Freezes or Account Fraud Alerts

If you have credit card freezes or fraud alerts on your account, you will not be able to post tradelines on your credit. When accounts are hit with fraud alerts, they freeze. This means that no new information can be added to the account. If you have fraud alerts on your accounts, you must contact credit bureaus to have them removed prior to adding tradelines to your account.

Not Having an Understanding of Tradelines

It is extremely important to have an understanding as to how tradelines work. If you do not understand how they work, you might not

find the right ones for the particular situation you are in. Make sure to give us a call here at Personal Tradelines if you are unsure which tradelines are best for your current situation.

A Lack Of Credit Score Knowledge

Before you go and purchase tradelines, you must understand how your credit score works. We have a few blogs on Personal Tradelines that help visitors gain a better understanding of the elements that compose a credit score. When you have the knowledge, you have the power. Having an understanding of how your credit score works can provide you with a better grip over your finances and your need for tradelines.

Buying Tradelines Based On Price

You don’t want to judge a tradeline based on the price of that tradeline. Many people assume that more expensive tradelines are more powerful, which is not true in the least. Yes, sometimes they can be, but the price is certainly not a determining factor.

Your credit utilization ratio is the amount of revolving credit you are using now divided by your total amount of revolving credit. Sometimes, people refer to this as a credit utilization ratio. Generally, this ratio is expressed as a percentage.

Let’s say you have two credit cards with $10,000 available in total. If you have a $5,000 balance on one, then you have a credit utilization rate of 50%.

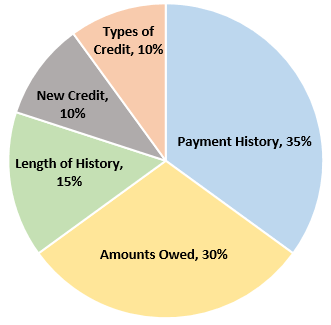

When calculating your credit score, credit scoring companies will use your credit utilization rate. This number often makes up next to 30% of a credit score, making it one of the most important numbers to look out for.

It is important to keep a low credit utilization rate, as it shows lenders that you don’t need to use all of your available credit. High credit utilization rates show lenders that you might be overspending, which can lower your credit score.

Understanding Revolving Credit

Revolving credit is the only type of credit that goes into a credit utilization ratio. Lines of credit and credit cards are types of revolving credit. Mortgages, auto loans, or installment loans, are not part of this ratio.

They call it “revolving credit” because the amount of credit you carry changes and carries over from month to month. There is no end date that is pre-determined. You borrow against your credit limit every month. Each time you borrow, you reduce the amount of credit that is available to you.

The important thing is that you don’t reach your credit limit and continue making on-time payments to make sure that your account stays in good standing. You also need to keep in mind that you’ll pay interest on this credit every month as well. To keep your credit utilization rate low and your interest from accruing, it is important to pay off your balance every month in full.

What Is a Credit Utilization Rate?

How Does Closing a Credit Card Impact Your Credit Utilization Rate?

Similar to the way that applying for a new credit card can have a negative impact in the short term, closing a credit account can also have a negative impact. Whenever you close your credit account, you reduce your limit overall. Closing a credit account won’t do anything if you don’t owe anything on your credit cards as it is, as your credit utilization rate is already 0.

Connecting My Credit Utilization Rate and My Credit Score

There are many factors that can impact your credit score and your credit utilization rate is just one of them. Keeping it low, however, can have a significant impact and help you maintain a higher score. Of course, increasing your credit score can come from many different actions.

Top Tradeline-Buying Mistakes

A person that has established credit might find a tradeline worth $1,000 and make the assumption that it is the best one for them. However, that particular tradeline could have a lower age or utilization ratio, which could either not affect that person’s credit at all or hurt that person’s credit in the long run.

Improvement is not adding more of what you already have. You want to select tradelines that are a good match for your credit.

Relying on Tradelines Alone

You can’t only rely on authorized user tradelines to help you with your credit. Most scoring models take your entire mix of credit into account, meaning it is far more desirable for one to have multiple kinds of good credit.

These different types of credit can include mortgage loans, car loans, installment loans, etc. You must also account for any late payments, delinquencies, or collections on your accounts, prior to purchasing tradelines as well.

What Tradelines to Buy?

The question of “which tradelines a person should buy” is probably one of the most important and often-asked questions that we get here at Personal Tradelines. Navigating the world of tradelines can be quite confusing, especially if you have never navigated it before.

Do note that there are many things to consider. Just as there is no other person like you on Earth, tradelines don’t work the same for every person.

There are different elements that come into play when deciding which tradelines to buy.

Come with us as we explore the ins and outs of which tradelines you should buy for your specific needs.

Choosing The Right Tradelines

To start, you need to determine what your priorities are when you are buying tradelines. What are you looking to accomplish? What are your financial goals?

In creating priorities for yourself, you will have a much easier time deciding on your future goals.

For example, you might choose to go with older tradelines if your main goal is to increase the overall age of your oldest account. This is especially true for young people or anyone who is just getting into the world of credit.

Which Tradelines Should I Buy?

If you focus on your credit limit and you want to lower your overall utilization ratio, then you might decide to go with tradelines that have a higher limit.

We have plenty of different tradelines here at Personal Tradelines for you to sift through. You can even sort out our list of tradelines based on certain factors like age and credit limit.

What About Perfect Payment History?

Payment history accounts for a whopping 35% of your credit score. In fact, it is one of the most important components when it comes to your credit score overall.

This is why we often put so much emphasis on buying tradelines that have perfect payment histories. You can do serious damage to your credit report with even one missed payment.

The beauty of all of our tradelines here at Personal Tradelines is that they have perfect payment histories. You never have to worry about whether or not purchasing trade lines for sale can help with your potentially imperfect payment history or whether or not a tradeline will lower your score.

The best way to buy a tradeline is to purchase one through a reputable company, and have that company help you choose which tradeline to buy. You want to make sure you buy your tradelines from a trusted source who can help you select the right tradelines for your credit needs.

It is usually not a good idea to buy a tradeline from an individual person, a company without an established track record, or if the price is too low and the deal seems “too good to be true.”

In the worst-case scenario, they could just take your money without making you an authorized user on the tradeline. In other cases, maybe the tradeline they sell you doesn’t have as high a credit limit as they promised, or the credit card account is very new (not aged or “seasoned”).

But if you buy your tradeline from a respected company, you can ensure that you get what you pay for, and that the tradeline will positively affect your credit score. Then you are able to accomplish your financial goals.

Here at Personal Tradelines we have 5 star ratings and have been in business since 2011. We have the experience to help you buy our seasoned tradelines at wholesale prices that will meet your needs. Plus, we offer a 60 day money back assurance that the tradeline will post to your credit report.

If you’re not sure which tradeline to buy, our experts can help you choose. The two main factors when buying tradelines are the account’s age, and credit limit. We verify all of our tradelines to make sure they have the stated account age and limit. How much of a credit boost you need determines which tradeline you should buy, and we can help figure that out.

To buy a tradeline, browse through our tradeline inventory and send us an email or call if you prefer. We also have packages which include multiple (2 to 5) tradelines. If you’re on a tighter budget we also have some tradelines under $500. Once you have an account registered with us, you will be able to access it 24/7, and even pre-order tradelines if you want.

Another good reason to buy tradelines from a company like Personal Tradelines is that we act as an intermediary between buyers and sellers, keeping both parties’ identities private. This way everyone is safe and secure with their financial information.

Besides buying tradelines, you can also sell them to us. If you would like to sell authorized user spots on your accounts, please visit our cardholders page and fill out the form.

Hopefully this post has answered for you how to buy a tradeline. In conclusion, the two main points are 1) Buy from a reputable tradeline company 2) Have them help you choose which tradeline to buy.

We hope you will choose us for all of your tradeline needs, and if you have any questions we are always here to help!